The tasks of a freelancer or a trader also include the fulfillment of tax obligations. Depending on turnover and profit limits, the entrepreneur must keep his books monthly and prepare a balance sheet at the end of the year. Those who are not required by law to keep books determine their taxable profit by comparing operating income and operating expenses. The figures from the net income statement are included in the EÜR annex of the private tax return. This applies not only to resellers but also to small business owners and freelancers, who are classified as small business owners under VAT law. You can find out more about registering a business in our blog article on the topic of registering a reselling business.

A tax consultant is often hired to take care of tax obligations. Those who do not want to invest such high costs in reselling prepare their surplus income statement with the support of an accounting program.

Which invoicing program is suitable for whom?

In the following, the accounting programs sevDesk and Lexoffice will be compared, as they are by far the most popular. Which software the user chooses depends, on the one hand, on the functions and interfaces provided by the two accounting software solutions. Questions arise here as to whether, for example, the accounting program fulfills the legal requirements of the GOBD or whether the cash balance is calculated automatically.

Another important point is professional support. What sales does an entrepreneur have to pay tax on? What belongs to the non-deductible business expenses? What applies if the small business regulation applies?

The app versions that sevDesk and LexOffice offer as a solution for entrepreneurs who are on the road a lot are also not uninteresting.

Last but not least, the decisive factor is the cost that an entrepreneur has to spend if he uses one of the two programs for the preparation of his accounting.

Comparison: the functions

SevDesk functions

For the user of sevDesk, the program enables many functions so that he can create proper accounting.

Accounting skills are not required here. Invoices, contracts, and other receipts can simply be photographed and scanned by the user or forwarded by e-mail. The accounting system assigns the document accordingly. In this way, receipts can be quickly recognized. Invoices are automatically posted by the system.

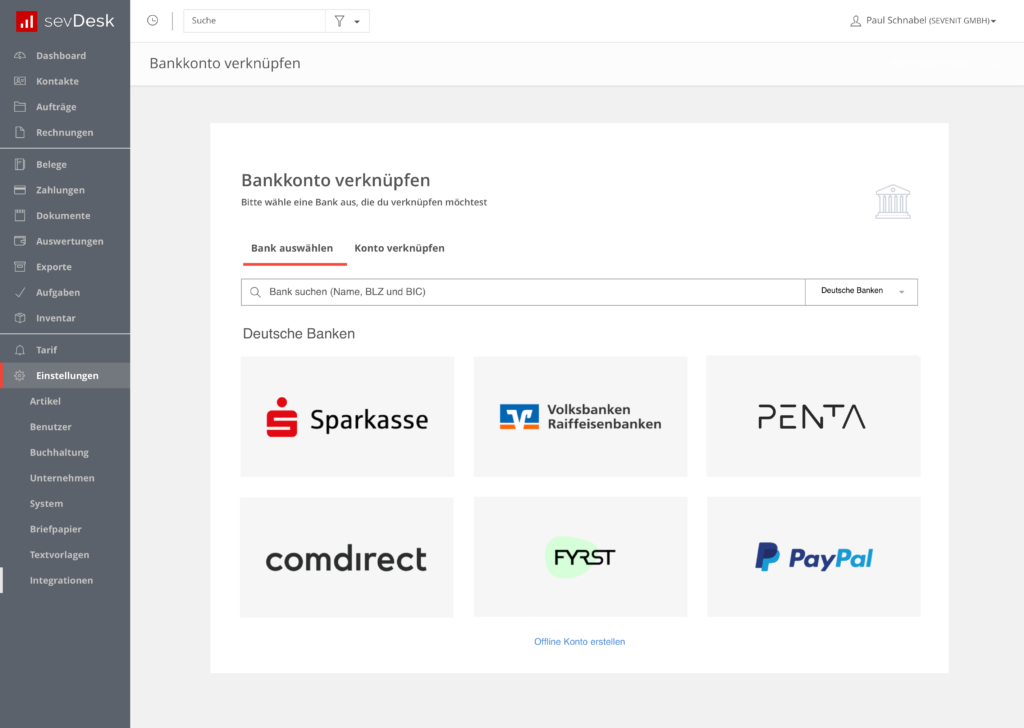

With sevDesk, separate posting of individual business transactions is no longer necessary. As soon as the connection between sevDesk and the bank is established, the system automatically recognizes the incoming payments and allocates them to the correct invoices.

Entrepreneurs subject to VAT benefit from easy handling when submitting the monthly advance VAT return.

Other useful features at Sevdesk include:

- Time tracking

- Customized invoice paper

- Order processing

- Create credit notes and cancellation invoices

- Send payment reminders and dunning letters

- Create a surplus income statement

- Keep cash book

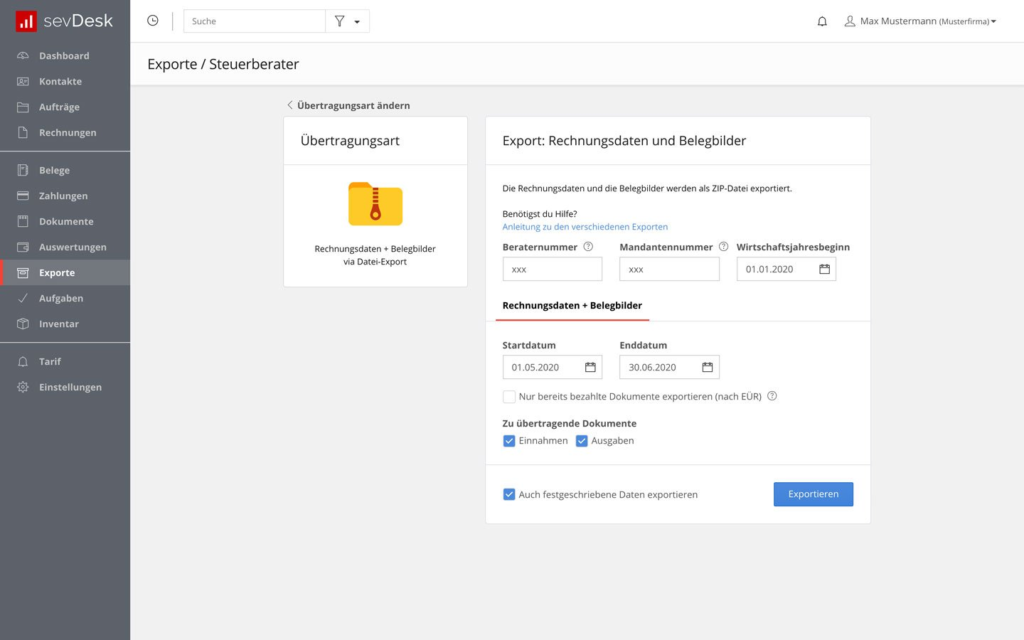

- Export data to the tax advisor

If you work with a tax consultant, use the export function of sevDesk. You benefit from a tutorial that guides you through all points of the program.

LexOffice functions

Those who choose LexOffice can use the following functions when preparing their monthly accounting:

All obligations that the tax office imposes on the entrepreneur are fulfilled by the LexOffice accounting program. The software can be used to conveniently create a cash book and transmit the advance VAT return to the tax office. All depreciation on tangible assets is recorded by the system. The user no longer has to worry about whether to book a GWG or whether the acquisition costs have to be distributed on a straight-line basis over the period of use.

If you have fixed assets, the asset accounting of LexOffice provides you with a comprehensive overview of the acquisitions. The program shows you when the fixed assets are fully depreciated.

Comparison: Interfaces

In addition to the interface to the tax advisor, the invoicing program from sevDesk has a partner at its side in Penta, which offers a complete solution for all things financial. Besides the link with the own business account, it is thus also possible for the user to establish a connection with the Paypal account.

If you decide to use sevDesk software, you will benefit from easy financial management and digitized output management.

LexOffice interfaces

Lexoffice offers its customers 30 interfaces that connect their own accounting with online stores, but also provide solutions for writing invoices and fulfilling tax obligations. If you offer your goods via an online store, you benefit from a real-time transfer of your data. Invoices are automatically created and sent to customers. The interfaces to the stores are installed via an app and can be easily integrated into your own accounting.

For the creation of a travel expense report, the LexOffice software also has an interface solution ready. The system additionally ensures that the travel expenses are posted to the correct accounts in financial accounting.

As a user, you benefit from the interface solution that lexOffice offers you when you prepare your tax returns yourself and submit them to the tax office. In addition to the income tax return, this also includes the sales tax return and the business tax return.

Professional support of the accounting programs

The advantages of an accounting program include not only easy handling of the user interface. The service includes an unbureaucratic contact and an answer to all important questions about the accounting program.

Lexoffice technical support

The FAQ section of LexOffice informs you as a user, for example, about the reduction of VAT. This came into effect on July 1, 2020, and will remain in effect until December 31, 2020. You can find out what this means for your company if you use the LexOffice software.

In addition, the LexOffice service area with its dictionary entries will answer your questions on these topics, for example:

- Outgoing documents

- Debt financing

- Maternity pay

- Record vouchers

- Fixed assets and depreciation

- Transmission of the advance VAT return with ELSTER

- Corona in everyday business

Use the FAQ section of LexOffice if you want to get comprehensive information about all questions regarding your invoicing program and tax issues. For example, if you want to take advantage of small business regulation, you can find out here which requirements you have to fulfill.

SevDesk technical support

SevDesk answers all important questions in a lexicon. As a user of the software solution, you can find out, for example, which tasks are involved in setting up a company, when you need to register your company in the commercial register and what a business plan for reselling looks like. Here you can find out what a non-cash benefit is, how to determine the break-even point and which invoice template you have to use for a private person.

As an entrepreneur who has to prepare a balance sheet, sevDesk provides you with the templates to create a balance sheet and the corresponding profit and loss statement.

For a comprehensive insight into all accounting and tax law, both sevDesk and LexOffice offer solutions that answer all your questions.

Accounting on the go: the app versions in comparison

The sevDesk-LexOffice comparison also includes the software solutions that both programs offer for accounting on the go. With sevDesk, an expansion of accounting is possible via IOS as well as via Android. The user photographs his receipts and transfers them digitally to the accounting program.

Sevdesk App

Sevdesk has just improved its service in this area. The two apps sevScan and sevDesk have been combined into one app – sevDesk Go. Additionally, some functions have been added. For example, as a user, you can now benefit from being able to select and upload photos from a photo album. Uploading from external service providers is also possible. If you have your data e.g. in Dropbox, on GoogleDrive, or on OneDrive, you can comfortably select them from there and import them into the accounting program of sevDesk. You can view the individual documents in a detailed view and easily create offers, invoices, reminders, and contacts for business partners and customers.

Logging into the app is required once via a QR code. You can archive received receipts in a legally secure manner. At the same time, you have fulfilled your legal obligation to keep records. If you decide to use the app solution from sevDesk, you can keep an eye on your finances wherever you are.

Lexoffice App

The LexOffice app also provides you with convenient support if you want to do your accounting on the go. The app works on all common smartphones and tablets. As a user, you can use all the functions that are also available to you on the desktop version. Create quotes and invoices when you’re on the train. Get an overview of your liquid assets with the financial check, even if you are not at home.

Choose the LexOffice app if you want ease of use and to benefit from fast and secure work. The app is practical and functional. With it, you can get a comprehensive overview of your company at any time and at any place.

Comparison: the cost

When comparing Sevdesk LexOffice in terms of cost, you must of course take into account what you get for your money as a user and what features you can use in your invoice program.

Sevdesk costs

With sevDesk, you can choose between three alternatives. If you only want to create your invoices quickly and conveniently, you can choose the “Invoice” package for 7.90 euros per month.

You can create invoices, cancellation invoices, and credit notes. The DATEV export is also available in this version for the document transfer to the tax advisor.

If you opt for the “Accounting” package, you pay 15.90 euros per month. In return, you can handle all your bookkeeping via the system and conveniently submit your advance VAT return to the relevant tax office. This version also allows you to record your fixed assets and depreciate them at the correct value.

The “Merchandise Management” package solves all the problems that arise in an entrepreneur’s everyday life. For 43.00 euros per month, you can set up a complete inventory management system and carry out regular inventory checks in addition to writing invoices and preparing the accounts.

LexOffice costs

If your decision is in favor of a LexOffice solution, you have the choice between these packages:

With the “Invoice & Finance” package, you create all offers and invoices for 5.14 euros per month. After the first year, the monthly subscription price increases to 7.90 euros. In return, you can easily reconcile payments with your online access.

With the “Invoice & Finance” package, you create all offers and invoices for 5.14 euros per month. After the first year, the monthly subscription price increases to 7.90 euros. In return, you can easily reconcile payments with your online access.

The “Accounting & Reports” package initially costs 10.98 euros per month. If you extend your subscription period, the price increases to 16.90 euros after the first 12 months. In return, you benefit from additional services that enable you, for example, to create a profit and loss statement or a summary report.

Conclusion

Both invoice programs have their advantages. There is no clear favorite. You should look at what individual requirements you have for an accounting program/invoice program and decide accordingly. Both are very good accounting programs with subtle differences. An accounting program helps you build a reselling business and also saves a lot of time.